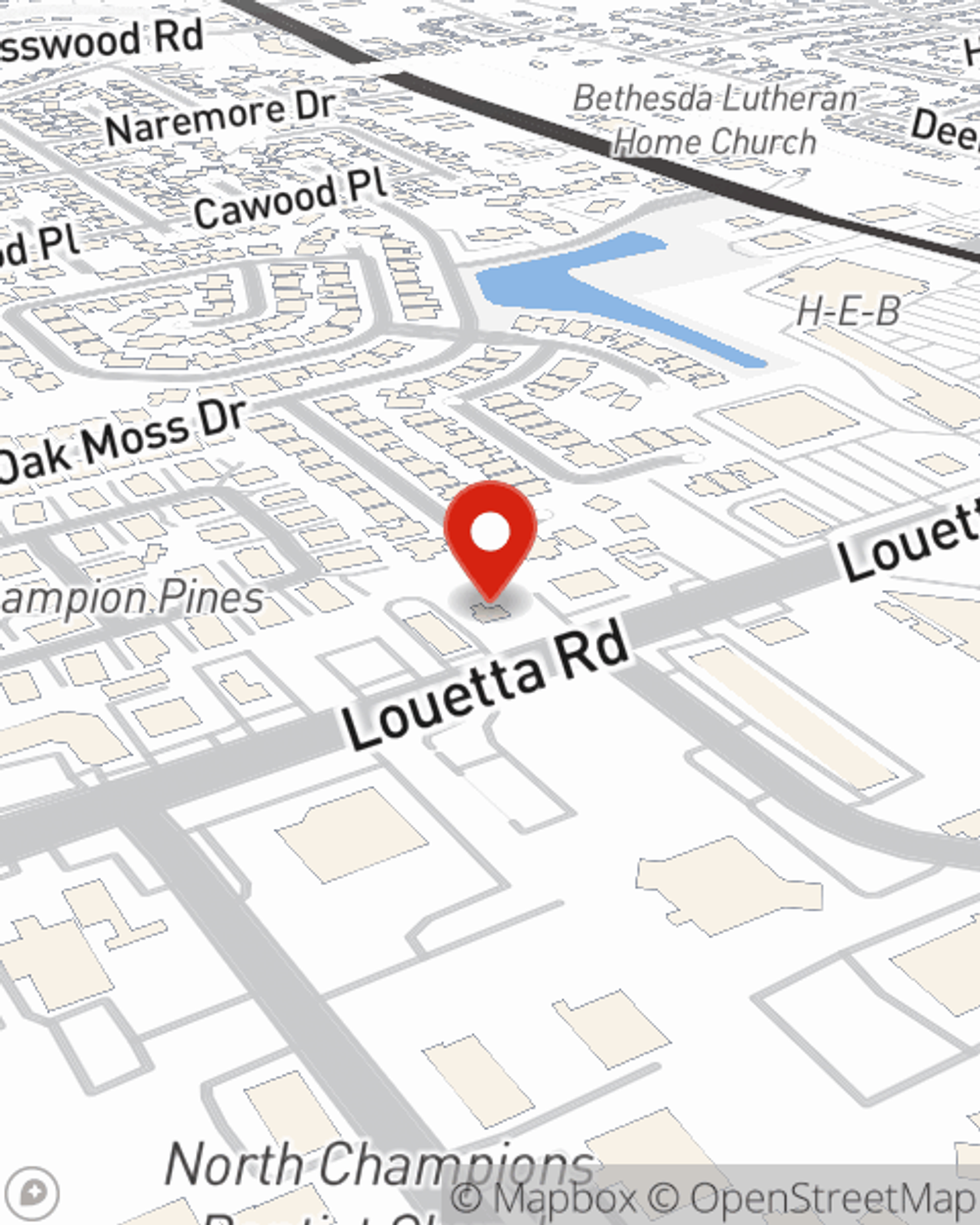

Homeowners Insurance in and around Spring

Looking for homeowners insurance in Spring?

Apply for homeowners insurance with State Farm

Would you like to create a personalized homeowners quote?

There’s No Place Like Home

You want your home to be a place to laugh and play when you've worked a long shift. That doesn't happen when you're worrying about making sure you don't burn the cake, and especially if your home isn't covered. That's why you need us at State Farm, so all you have to worry about is the first part.

Looking for homeowners insurance in Spring?

Apply for homeowners insurance with State Farm

Open The Door To The Right Homeowners Insurance For You

From your home to your prized collectibles, State Farm is here to make sure your valuables are covered. Randy Reeves would love to help you know what insurance fits your needs.

Don’t let fears about your home stress you out! Call or email State Farm Agent Randy Reeves today and explore how you can meet your needs with State Farm homeowners insurance.

Have More Questions About Homeowners Insurance?

Call Randy at (281) 370-1700 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Tips to help prevent burglary

Tips to help prevent burglary

Consider these home burglary prevention ideas to help protect your home.

How to use public Wi-Fi safely

How to use public Wi-Fi safely

When using a public Wi-Fi access there can be risks involved. We’ve provided some steps to help protect your information.

Randy Reeves

State Farm® Insurance AgentSimple Insights®

Tips to help prevent burglary

Tips to help prevent burglary

Consider these home burglary prevention ideas to help protect your home.

How to use public Wi-Fi safely

How to use public Wi-Fi safely

When using a public Wi-Fi access there can be risks involved. We’ve provided some steps to help protect your information.